Welcome to

Wealth Protectors

HOW INDEXED UNIVERSAL LIFE WORKS

Discover how wealthy people have leveraged cash value life insurance policies

for over 200 years to grow their money and avoid paying taxes legally!

Discover how we help individuals and small business owners protect their financial future using The Little-Known Index Universal Life Insurance Policy that industry

giants can't seem to stop talking about...

Unlock compounding interest, enjoy tax-free retirement income, and protect yourself with living benefits & build generational wealth for your family.

Indexed universal life insurance is a type of permanent life insurance that has a cash value component in addition to a death benefit. The money in your cash value account can earn interest based on a stock market index chosen by the insurance company, such as the S&P 500.

There are many advantages to having an IUL policy:

Less risk: The cash value is not directly invested in the stock market, thus reducing risk to zero.

Interest rate ranges from 5 -10% annually (Depending on the indexed performance)

Tax free- You don’t pay taxes on interest earned

Easy distribution: The cash value in IUL policies can be accessed at any time without penalty, regardless of a person’s age.

Retirement Supplement: When structured and funded properly it can be used as a tax free retirement income

Access death benefit: You can access 80-100% of the death benefit if you become Critically, Terminally, or Chronically ill.

Death benefit: This benefit is permanent, not subject to income or death taxes, and not required to go through probate.

Unlimited contribution: IUL insurance policies have no limitations on annual contributions. This means you can put in extra money in the cash value and earn interest on it.

On average most people start with $300. For our clients that want to max fund their policy for faster and more cash accumulation growth they typically start with $1000 and above.

You can either withdrawal the cash value, which will reduce or deplete what you have accumulated, or you can take out a loan against the cash value.

It is more beneficial to take out a loan. When the insurance company gives a loan they are not necessarily taking it from your money. Your money is being held as a collateral against the loan, which means you earning uninterrupted compound interest.

If you do pass way in the process of paying back your loan, the loan balance will be deducted from your cash value and whatever is left will be paid out to your beneficiary.

Yes, you are allowed to increase your premium up to a certain amount annually depending on how your policy is structured.

It depends on how your policy is setup. If its a “level” policy then only the death benefit gets paid out. If its an “increasing” policy then the cash value is added to the death benefit and paid out to your beneficiary. For example, if you pass away and you have $50,000 in cash value and $300,000 in death benefit, your beneficiary will receive a total of $350,000.

Generally, IUL policies does not require medical exams. However, during the application process, you will need to give HIPPA consent to the insurance company to access your medical record to make sure that you do not have any major health issues. In some cases, medical exam may be required based on medical history.

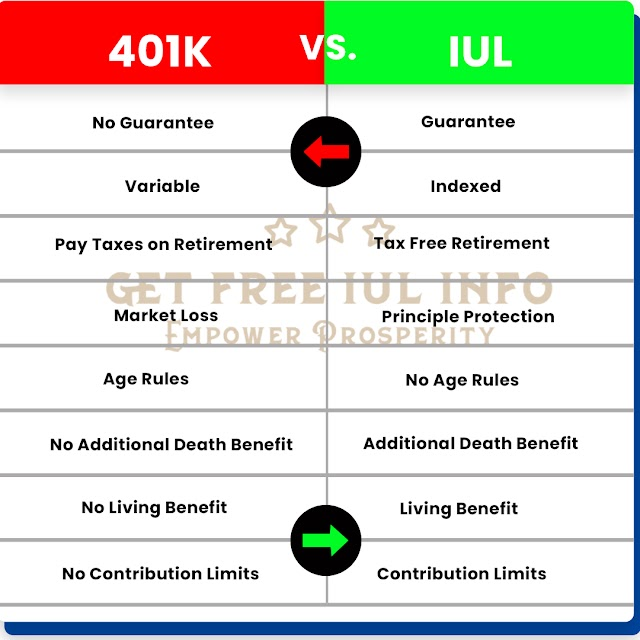

401k and IRA are both considered investments, while IUL is not. However, IUL does offer several benefits, which are not available with both 401k and IRA. (i.e. protection from market volatility)

When an insurance company becomes financially unstable and can’t pay policyholder claims, the state’s insurance commissioner can take over the company through a process called receivership. First, the commissioner will try to rehabilitate the company to improve its financial situation. If that doesn’t work, the commissioner can declare the company insolvent and sell off its assets, according to the National Organization of Life & Health Insurance Guaranty Associations.

If an insurance company is declared insolvent, the state guaranty association and guaranty fund swing into action. The association will transfer the insurer’s policies to another insurance company or continue providing coverage itself for policyholders.

When a premium is paid, a portion of the premium pays for the cost of insurance, and the difference goes into the cash value account. Based on how the stock market index performs, the cash value can be credited 5-10% interest annually. Note: your money is not invested directly in the market, so you never lose what you have accumulate in your cash value when the market goes down.

There are few disadvantages to IUL. First, depending on how the policy is being funded, it can take years for the cash value to grow. Secondly, the cost of insurance could be high depending on your age and health condition. Finally, there is a possibility that in some years you might not earn any interest if the index does not perform well. This simply means that you will not gain or lose anything in your cash value for that year.

No, you do not pay taxes on funds accessed from the policy as a loan and the policy remains enforces. If you decide to cancel the policy you will be required to pay taxes on any “interested earned” in your cash value.

Generally, it takes 5- 10 years for you to accumulate enough funds to withdrawal, and the minimum you can withdrawal is $500. However, you can access funds in your cash value after 12 months “IF” you max fund your policy to the MEC limit.

Yes, but it depends on how the policy is setup from the beginning. A high death benefit gives you the ability to over fund the policy with more money. You would need to speak to an advisor for more clarification.

Anyone from 15 days old and above can qualify for an IUL.

Below are some of the reasons why a person can get denied for IUL:

A felony within 5-10 years

Currently on probation

DWI or DUI within 5 years

Overweight (Depends on height)

Personal history of cancer

History of alcohol or substance abuse

Life, health, or disability insurance that has been rated or declined

Major medical conditions

Alcohol Abuse

IUL’s cash value growth is based on the stock market indexed performance, as a result there is a higher probability of receiving a higher interest rate up to 10% or more. On the other hand, Whole Life cash value growth is based on the company’s performance, so the maximum interest rate is often capped around 5%.

You can only get an IUL through a licensed insurance agent who is appointed with specific carriers that offers IUL. Our agents are licensed nationwide with several carriers that offers IUL.

01

Indexed universal life insurance is a type of permanent life insurance that has a cash value component in addition to a death benefit. The money in your cash value account can earn interest based on a stock market index chosen by the insurance company, such as the S&P 500.

02

When a premium is paid, a portion of the premium pays for the cost of insurance, and the difference goes into the cash value account. Based on how the stock market index performs, the cash value can be credited 5-10% interest annually. Note: your money is not invested directly in the market, so you never lose what you have accumulate in your cash value when the market goes down.

03

There are many advantages to having an IUL policy:

Less risk: The cash value is not directly invested in the stock market, thus reducing risk to zero.

Interest rate ranges from 5 -10% annually (Depending on the indexed performance)

Tax free- You don’t pay taxes on interest earned

Easy distribution: The cash value in IUL policies can be accessed at any time without penalty, regardless of a person’s age.

Retirement Supplement: When structured and funded properly it can be used as a tax free retirement income

Access death benefit: You can access 80-100% of the death benefit if you become Critically, Terminally, or Chronically ill.

Death benefit: This benefit is permanent, not subject to income or death taxes, and not required to go through probate.

Unlimited contribution: IUL insurance policies have no limitations on annual contributions. This means you can put in extra money in the cash value and earn interest on it.

04

There are few disadvantages to IUL. First, depending on how the policy is being funded, it can take years for the cash value to grow. Secondly, the cost of insurance could be high depending on your age and health condition. Finally, there is a possibility that in some years you might not earn any interest if the index does not perform well. This simply means that you will not gain or lose anything in your cash value for that year.

05

On average most people start with $300. For our clients that want to max fund their policy for faster and more cash accumulation growth they typically start with $1000 and above.

06

No, you do not pay taxes on funds accessed from the policy as a loan and the policy remains enforces. If you decide to cancel the policy you will be required to pay taxes on any “interested earned” in your cash value.

07

You can either withdrawal the cash value, which will reduce or deplete what you have accumulated, or you can take out a loan against the cash value.

It is more beneficial to take out a loan. When the insurance company gives a loan they are not necessarily taking it from your money. Your money is being held as a collateral against the loan, which means you earning uninterrupted compound interest.

If you do pass way in the process of paying back your loan, the loan balance will be deducted from your cash value and whatever is left will be paid out to your beneficiary.

08

Generally, it takes 5- 10 years for you to accumulate enough funds to withdrawal, and the minimum you can withdrawal is $500. However, you can access funds in your cash value after 12 months “IF” you max fund your policy to the MEC limit.

09

Yes, you are allowed to increase your premium up to a certain amount annually depending on how your policy is structured.

10

Yes, but it depends on how the policy is setup from the beginning. A high death benefit gives you the ability to over fund the policy with more money. You would need to speak to an advisor for more clarification.

11

It depends on how your policy is setup. If its a “level” policy then only the death benefit gets paid out. If its an “increasing” policy then the cash value is added to the death benefit and paid out to your beneficiary. For example, if you pass away and you have $50,000 in cash value and $300,000 in death benefit, your beneficiary will receive a total of $350,000.

12

Anyone from 15 days old and above can qualify for an IUL.

13

Generally, IUL policies does not require medical exams. However, during the application process, you will need to give HIPPA consent to the insurance company to access your medical record to make sure that you do not have any major health issues. In some cases, medical exam may be required based on medical history.

14

Below are some of the reasons why a person can get denied for IUL:

A felony within 5-10 years

Currently on probation

DWI or DUI within 5 years

Overweight (Depends on height)

Personal history of cancer

History of alcohol or substance abuse

Life, health, or disability insurance that has been rated or declined

Major medical conditions

Alcohol Abuse

15

401k and IRA are both considered investments, while IUL is not. However, IUL does offer several benefits, which are not available with both 401k and IRA. (i.e. protection from market volatility)

16

IUL’s cash value growth is based on the stock market indexed performance, as a result there is a higher probability of receiving a higher interest rate up to 10% or more. On the other hand, Whole Life cash value growth is based on the company’s performance, so the maximum interest rate is often capped around 5%.

17

When an insurance company becomes financially unstable and can’t pay policyholder claims, the state’s insurance commissioner can take over the company through a process called receivership. First, the commissioner will try to rehabilitate the company to improve its financial situation. If that doesn’t work, the commissioner can declare the company insolvent and sell off its assets, according to the National Organization of Life & Health Insurance Guaranty Associations.

If an insurance company is declared insolvent, the state guaranty association and guaranty fund swing into action. The association will transfer the insurer’s policies to another insurance company or continue providing coverage itself for policyholders.

18

You can only get an IUL through a licensed insurance agent who is appointed with specific carriers that offers IUL. Our agents are licensed nationwide with several carriers that offers IUL.

03

There are many advantages to having an IUL policy:

Less risk: The cash value is not directly invested in the stock market, thus reducing risk to zero.

Interest rate ranges from 5 -10% annually (Depending on the indexed performance)

Tax free- You don’t pay taxes on interest earned

Easy distribution: The cash value in IUL policies can be accessed at any time without penalty, regardless of a person’s age.

Retirement Supplement: When structured and funded properly it can be used as a tax free retirement income

Access death benefit: You can access 80-100% of the death benefit if you become Critically, Terminally, or Chronically ill.

Death benefit: This benefit is permanent, not subject to income or death taxes, and not required to go through probate.

Unlimited contribution: IUL insurance policies have no limitations on annual contributions. This means you can put in extra money in the cash value and earn interest on it.

04

There are few disadvantages to IUL. First, depending on how the policy is being funded, it can take years for the cash value to grow. Secondly, the cost of insurance could be high depending on your age and health condition. Finally, there is a possibility that in some years you might not earn any interest if the index does not perform well. This simply means that you will not gain or lose anything in your cash value for that year.

05

On average most people start with $300. For our clients that want to max fund their policy for faster and more cash accumulation growth they typically start with $1000 and above.

06

No, you do not pay taxes on funds accessed from the policy as a loan and the policy remains enforces. If you decide to cancel the policy you will be required to pay taxes on any “interested earned” in your cash value.

07

You can either withdrawal the cash value, which will reduce or deplete what you have accumulated, or you can take out a loan against the cash value.

It is more beneficial to take out a loan. When the insurance company gives a loan they are not necessarily taking it from your money. Your money is being held as a collateral against the loan, which means you earning uninterrupted compound interest.

If you do pass way in the process of paying back your loan, the loan balance will be deducted from your cash value and whatever is left will be paid out to your beneficiary.

08

Generally, it takes 5- 10 years for you to accumulate enough funds to withdrawal, and the minimum you can withdrawal is $500. However, you can access funds in your cash value after 12 months “IF” you max fund your policy to the MEC limit.

09

Yes, you are allowed to increase your premium up to a certain amount annually depending on how your policy is structured.

10

Yes, but it depends on how the policy is setup from the beginning. A high death benefit gives you the ability to over fund the policy with more money. You would need to speak to an advisor for more clarification.

11

It depends on how your policy is setup. If its a “level” policy then only the death benefit gets paid out. If its an “increasing” policy then the cash value is added to the death benefit and paid out to your beneficiary. For example, if you pass away and you have $50,000 in cash value and $300,000 in death benefit, your beneficiary will receive a total of $350,000.

12

Anyone from 15 days old and above can qualify for an IUL.

13

Generally, IUL policies does not require medical exams. However, during the application process, you will need to give HIPPA consent to the insurance company to access your medical record to make sure that you do not have any major health issues. In some cases, medical exam may be required based on medical history.

14

Below are some of the reasons why a person can get denied for IUL:

A felony within 5-10 years

Currently on probation

DWI or DUI within 5 years

Overweight (Depends on height)

Personal history of cancer

History of alcohol or substance abuse

Life, health, or disability insurance that has been rated or declined

Major medical conditions

Alcohol Abuse

15

401k and IRA are both considered investments, while IUL is not. However, IUL does offer several benefits, which are not available with both 401k and IRA. (i.e. protection from market volatility)

16

IUL’s cash value growth is based on the stock market indexed performance, as a result there is a higher probability of receiving a higher interest rate up to 10% or more. On the other hand, Whole Life cash value growth is based on the company’s performance, so the maximum interest rate is often capped around 5%.

17

When an insurance company becomes financially unstable and can’t pay policyholder claims, the state’s insurance commissioner can take over the company through a process called receivership. First, the commissioner will try to rehabilitate the company to improve its financial situation. If that doesn’t work, the commissioner can declare the company insolvent and sell off its assets, according to the National Organization of Life & Health Insurance Guaranty Associations.

If an insurance company is declared insolvent, the state guaranty association and guaranty fund swing into action. The association will transfer the insurer’s policies to another insurance company or continue providing coverage itself for policyholders.

18

You can only get an IUL through a licensed insurance agent who is appointed with specific carriers that offers IUL. Our agents are licensed nationwide with several carriers that offers IUL.